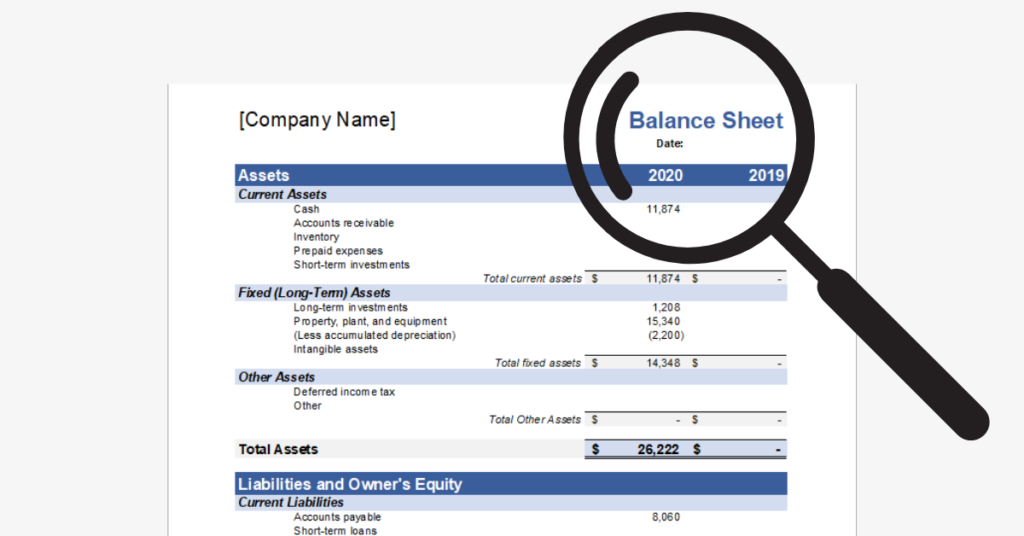

A Balance Sheet, otherwise known as the statement of financial position, reveals your firm’s assets, liabilities and owner’s equity at a specific point in time. Self-employed, sole-proprietors and precedent partners use the balance sheet, as part of the Statement of Accounts, to file taxes.

In addition, current and potential investors may use it to gauge where their funding will go and when they can expect repayment in the future.

What is in your balance sheet?

Three key elements form the balance sheet equation:

Assets = Liabilities + Shareholders’ Equity

As shown in the equation, a balance sheet has two portions and both sides must always be equal. A company’s total assets must be sufficiently balanced by its obligations and liabilities.

Assets

Assets typically refer to anything owned by a company that creates or has value. They are further categorised into current and noncurrent.

Current assets have a lifespan of about one year, and are thus easily convertible to cash, such as:

- Cash, including petty cash and bank deposits

- Accounts Receivable, within 1 year

- Inventories

- Other cash equivalent receivables

Non-current assets are not readily convertible and can only be collected after a year, such as:

- Property, Plant and Equipment (PP&E)

- Receivables, collectable after 1 year

- Intangible assets such as Goodwill and Copyrights

Liabilities

Liabilities are financial obligations which a company owes to its vendors and other stakeholders. Similar to assets, liabilities can be short or long term.

Current liabilities refer to payments which are payable within a year, such as:

- Accounts payable

- Tax payable

- Short term loans

- Provisions

Non-current liabilities include

- Expenses payable, after 1 year

- Deferred taxation

Shareholders’ Equity

Shareholders’ or owners’ equity represents the total net worth of a company if it were to sell off all its assets and resolve all its liabilities. It comprises the initial capital invested by the owner, and earnings of a company—which become retained earnings when they are reinvested into the business. These can then be distributed to shareholders in the form of dividends.

The Balance Sheet is effective in reporting the funding and obligations of a business, and is an essential tool to determine the financial condition of a company at a particular point of time. A balance sheet has to be properly recorded for an entity to understand its profit or loss, and make better investment decisions.

Depending on what an investor is trying to derive, they will derive insight from different parts of the balance sheet. Similarly, for creditors to profit, they must evaluate the solvency and liquidity.

It is important to understand the balance sheet in conjunction with other financial reports such as the Income Statement and Statement of Cash Flows, that has to be properly reported under Section 201(2) and Section 201(5) of the Companies Act, to allow a complete financial picture of a firm.

Looking for an accountant who can help you understand how your financial data can help grow your business? We’re here to help. Talk to us today.