The Singapore economy is expected to recover from the effects of the COVID-19 crisis, but longer-term challenges remain for some sectors.

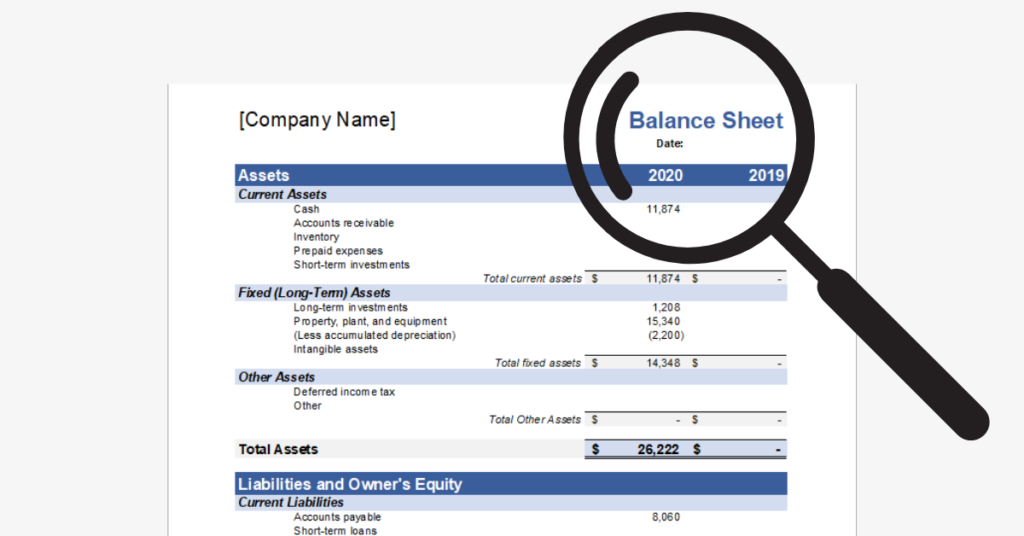

Small and medium-sized enterprises (SMEs), at minimum, need to generate sufficient cash flow to stay afloat. As they typically have smaller cash reserves, government support measures can be a lifeline for the hardest hit ones.

In July 2021, Finance Minister Lawrence Wong announced that the Temporary Bridging Loan Programme and the Enhanced Enterprise Financing Scheme – Trade Loan will be extended for six more months, from 1 Oct 2021 to 31 March 2022.

Here are the details in full:

Extended Support Scheme (ESS)

Introduced on 5 October 2020, the Monetary Authority of Singapore (MAS) and several other financial institutions announced an extension of supporting measures to tackle and alleviate the heavy cash flow challenges experienced by SMEs.

The application period for this initiative has been extended from 30 June 2021 to 30 September 2021. Under this scheme, SMEs are given a choice to defer up to 80% of their principal payments on the loans granted by certified financial institutions. This also applies to the Temporary Bridging Loan Programme- which will be covered in a later section.

Eligibility

This scheme can be adopted by firms with loan repayments that are no more than 30 days past due. In addition, firms who have been granted partial principal moratorium on their loans should not possess any payments that are overdue.

Temporary Bridging Loan Programme (TBLP)

The TBLP provides businesses with access to greater working capital to finance their daily operations.

Timeline

Upon the release of this initiative, eligible enterprises were entitled up to a five million dollar (SGD) loan- with an interest cap of up to 5%. After the enhancement of this initiative in the second quarter of 2020, the government risk-share percentage was situated at 90%.

In view of the progressive recovery in the last quarter of 2020, adjustments were made to extend the application period of the TBLP. At the same time, the government’s risk share percentage was lowered to 70%, in accordance with a reduced maximum loanable amount of 3 million dollars (1 April 2021 to 30 September 2021).

As part of the heightened alert measures adopted to re-invigorate the economy, the government has recently announced another extension of the TBLP under the same stipulated conditions as before. This extension will last from 1st October 2021 to 31 March 2022.

Eligibility

To apply for the TBLP, you must fulfil all five of the following conditions:

- Your firm must be a ACRA-registered business entity

- In operation for at least a year

- Commercial operations must be physically present in Singapore

- Has an annual turnover of at least hundred thousand ($100K) or more

- A minimum of 30% shareholding possessed by a Singapore PR or Singaporean

*Note that the approval of the TBLP is still dependent on the assessments made by participating financial institutions.

Apply for government credit schemes with confidence. We can help do your bookkeeping and organise your financials. Talk to us today.