Question: What’s better than filing your taxes correctly? Getting someone else to do it for you in the first place!

That taxes are universally loathed is an understatement: For sole proprietorships and partnerships, determining your chargeable income, figuring out deductions and tax reliefs, as well as, plowing through tricky regulatory issues can pose a huge encumbrance on your resources.

Bearing in mind that taxation works mostly in the same manner for sole proprietorships and partnerships, whereby the business’ profits are passed through to the owners and are reported on their personal tax returns, let’s take a closer look at the essential information that IRAS wants from you:

Filing taxes for sole proprietorship

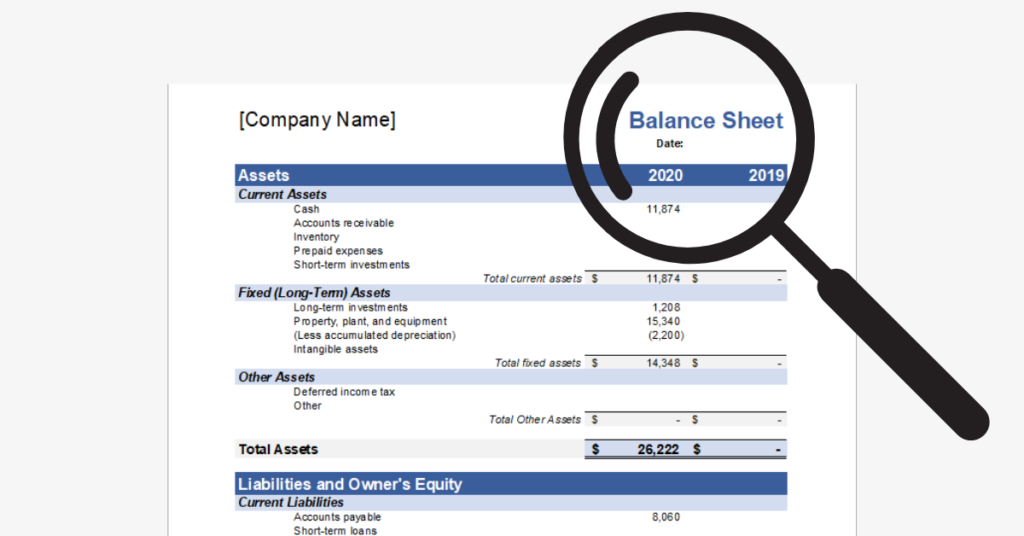

Sole proprietors are required to file a tax return (Form B or B1) every year for trade income earned in the previous year. On the form, you need to prepare:

- Revenue

- Gross profit/loss

- Allowable business expenses

- Adjusted profit/loss

Here are some basic regulations that will impact reporting:

- If your revenue is less than S$100,000 annually, you can skip reporting allowable business expenses and adjusted profit/loss.

- If your revenue is more than S$500,000 annually, you are required to submit a certified statement of accounts alongside Form B or B1.

- If your revenue exceeded S$1 million in the last 12 months, or is expected to exceed S$1 million in the next 12 months, you should register yourself for GST.

Filing taxes for partnerships

Even though the partnership itself does not pay taxes, the precedent partner is required to file an annual income tax return (Form P) to show all income earned and business expenses deducted by the partnership during the year. Each partner will then be taxed on his or its share of the income from the partnership.

On the form, you need to prepare:

- Revenue

- Gross profit/loss

- Allowable business expenses

- Adjusted profit/loss

Here are some basic regulations that will impact reporting:

- If your revenue is more than $500,000 annually, you’re required to submit the certified statement of accounts of your business alongside Form P.

- All partners, including the precedent partner, must report their share in the business income using Form B or B1.

- Where the partner is an individual, his share of income from the LP will be taxed based on his personal income tax rate. Where a partner is a company, its share of income from the LP will be taxed at the tax rate for companies.

It’s important to note that sole proprietors and partners are required to keep proper records and accounts of business transactions for five years. They must also be able to support their records and accounts with invoices, receipts, vouchers and other relevant documents.

While some people choose to file their annual tax return themselves using Excel or DIY accounting software, the benefits of hiring a good tax service are multifold.

As a CountoTax customer, you’ll have access to a team of professionals who make sure you always maintain excellent records. Besides that, a powerful platform for organising, storing and retrieving every receipt and invoice.

Not only do we keep your business financially up-to-date throughout the year, we handle all your tax obligations as part of your accounting plan. Or, if you just need one-off tax time support, through our affordable tax preparation packages. Whatever stage you are at, we have you covered.

Need a reliable tax solution? Find out how Counto can take care of your taxes and bookkeeping, all in one place. Contact us today!