As COVID-19 continues to ravage economies, small businesses need to ramp up measures to preserve cash and protect market share. Or go bust. Here, we present five strategies to help you prepare your business for the worst to come.

Feeling flat-out stressed and overwhelmed by the economic impact of the COVID-19 virus swamping countries and financial markets? You’re not alone.

With fear in the air, stocks in free fall, and the likelihood of a global recession looming, few communities and industries are unlikely to escape unscathed.

For small business owners, that debilitating feeling of anxiety and despair might be all too familiar. Beyond the psychological pressure of coping with a prolonged downturn, business and personal overheads have to be trimmed while the bills start tumbling in.

As money gets tight, here are five ways to help you steer your company through troubled waters:

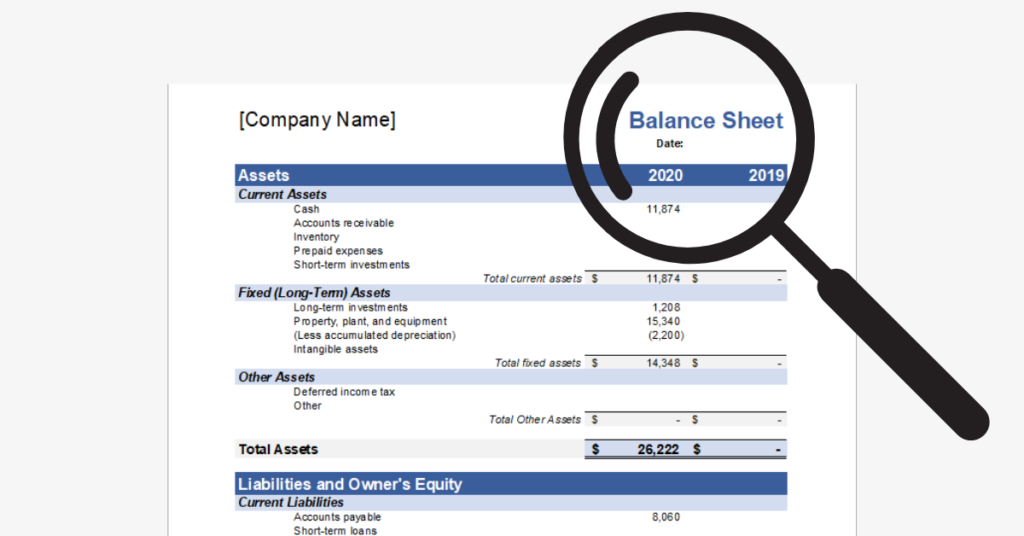

- First on the list – cash flow management. Unlike a Budget which maps out an estimation of revenue and expenditure over a year, cash flow forecasts cover a short-term period. Aim to develop a six-week projection. Our blog post “How to tackle cash flow squeeze—the number 1 killer of 82% of small businesses” mentions three ways to get cash flow pumping.

- Reset strategies and redouble marketing efforts. This is the time to make your product or service more appealing and broaden your customer base. Seek out business collaboration possibilities or barter services with another small business. And, never sacrifice marketing.

- Use technology to spark growth. A Harvard Business Study showed that early adoption of new technologies leads to huge business payoffs like revenue growth and increased profit margins. Create an online customer loyalty program, do email marketing and optimise your website for search engine rankings. Don’t know how to start? Upwork.com is a popular freelance job site where you can find talented designers.

- Take advantage of low-cost services. At Counto, we provide accounting and tax services at incredibly affordable prices, reducing the total cost of your bookkeeping by at least 50% compared to traditional accountants.

- Control business costs. Can you rent instead of buy? Consider putting your team in a co-working space instead of regular offices. Explore equipment rental sites like justrentlah.com for yet more cost-cutting options.

Small businesses are a key driver of Singapore’s economy. However, today’s environment is an ever-changing one. The failure to adapt quickly can have inexorably brutal effects, even for the hardiest of entrepreneurs.

Foster solidarity within the local business community by supporting like-minded companies through partnerships and collaborations. The Entrepreneurs’ Organization (EO) is a great place to help grow your knowledge and network.

Every little bit helps. As a small businesses owner himself, my dad used to remind me: spend my cash at a mom-and-pop shop versus a chain store. This piece of advice bears even more weight as small businesses brace themselves for another tumultuous day in the COVID-19 era.

Try Counto for free. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Contact us today!