Key Differences in Compliance Between Sole Proprietorships and LLPs in Singapore

When starting a business in Singapore, small and medium enterprises (SMEs) often consider various structures, with Sole Proprietorship (SP) and Limited Liability Partnership (LLP) being two common options. Each has distinct compliance requirements and implications. This blog highlights the key differences in compliance between Sole Proprietorships and LLPs, helping you make an informed choice.

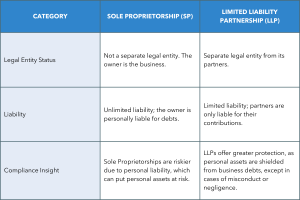

1. Legal Entity and Liability

Example: A freelance graphic designer operating as a Sole Proprietorship could risk personal assets if a client sues for damages. In contrast, an LLP formed by several designers would limit personal liability to their capital contributions.

2. Annual Filing Requirements

Example: A sole proprietor running an online retail shop can operate without annual returns, while a consulting firm structured as an LLP must file solvency declarations, adding an extra layer of compliance responsibility.

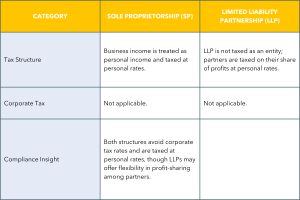

3. Taxation

Example: A sole proprietor’s earnings from a baking business are taxed as personal income, while partners in an LLP running a tech startup report their respective shares of profits on their personal tax returns.

✅ Tired of surprise fees from accounting services? We prioritise your savings and efficiency. From multicurrency accounting to tax filing, Counto handles it all—with unlimited transactions. Explore our transparent, all-in-one pricing here.

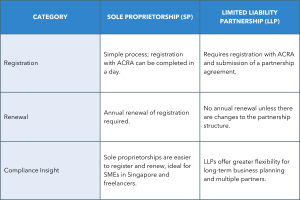

4. Registration and Renewal Process

Example: A freelance writer can quickly set up a Sole Proprietorship in a day, while a digital marketing agency that opts for an LLP must prepare a partnership agreement and may take longer to establish.

5. Name Protection and Branding

Example: A sole proprietor running a local café may need to trademark their business name to protect it, while an LLP operating a law firm benefits from automatic name protection under ACRA.

6. Business Closure

Example: A sole proprietor running a seasonal flower shop can easily close the business by notifying ACRA, whereas an LLP operating a real estate agency must follow a formal dissolution process, which can be more complex.

Summary

Choosing between a Sole Proprietorship and an LLP is crucial for SMEs in Singapore. Sole Proprietorships provide simplicity and lower compliance costs, but they come with unlimited personal liability. Conversely, LLPs offer limited liability protection, making them suitable for businesses with multiple partners or growth ambitions. Understanding these differences is essential for successful compliance and sustainable growth in Singapore’s competitive market.

Switch to a trusted Outsourced Accounting Service

Counto exists to help small businesses like you save time and money throughout the year. Get direct access to a dedicated Customer Success Manager, who’s backed by a team of accountants and tax specialists. Discover a smarter way to outsource your accounting with confidence.Speak to us directly on our chatbot, email [email protected], or use our contact form to get started.

Here are some articles you might find helpful: