A Director’s Handbook to Paying Yourself

As a sole company director, you hold the reins of your business, making critical decisions and managing your enterprise’s day-to-day operations. But when it comes to rewarding yourself for your hard work, navigating the realm of salary payments can be complex. In this guide, we’ll explore various methods and strategies for paying yourself as a sole director, ensuring both financial stability and tax efficiency.

Understanding Your Options

Paying yourself as a director offers flexibility and autonomy. Let’s explore the diverse avenues available to you:

1. Pay Yourself a Salary:

- Establish a regular monthly pay check, akin to employee compensation.

- Conduct industry research to set a competitive salary benchmark.

- Alternatively, customise income distribution based on profits and operating agreements.

2. Pay Yourself as an Independent Contractor:

- Leverage specialised skills to work as an independent contractor for your business.

- Enjoy the flexibility of self-employment with customised payment arrangements.

3. Pay Yourself as a Member of an LLC:

- Allocate profits per the operating agreement in a multi-member LLC.

- As a solo director, enjoy the autonomy to determine profit allocation.

Ensuring Tax Efficiency and Legal Compliance

Optimising salary payments requires careful consideration of tax implications and legal obligations. Here’s how to navigate these aspects effectively:

1. Tax Implications:

- As a director receiving a salary or fee, the company incurs expenses, reducing taxable profits.

- Personal income taxes apply to the director’s income.

- Not paying a salary or fee may increase company profits, leading to higher corporate taxes.

- Dividends issued after tax are tax-free for shareholders, as taxes have already been paid by the company.

2. Legal Compliance:

- Familiarise yourself with regulatory requirements governing salary payments.

- Ensure compliance with tax laws and regulations to avoid penalties or audits.

- Seek guidance from tax professionals to optimise salary structures within legal boundaries.

Bonus Tips for Effective Payment

Elevate your salary strategy with these additional insights:

1. Pay from Profits, Not Revenue:

Base compensation on business profitability to safeguard financial stability.

2. Value Your Worth:

Set a salary reflective of your contributions, ensuring fair compensation for expertise.

3. Establish Regular Payments:

Formalise inclusion in the payroll and adhere to a consistent payment schedule.

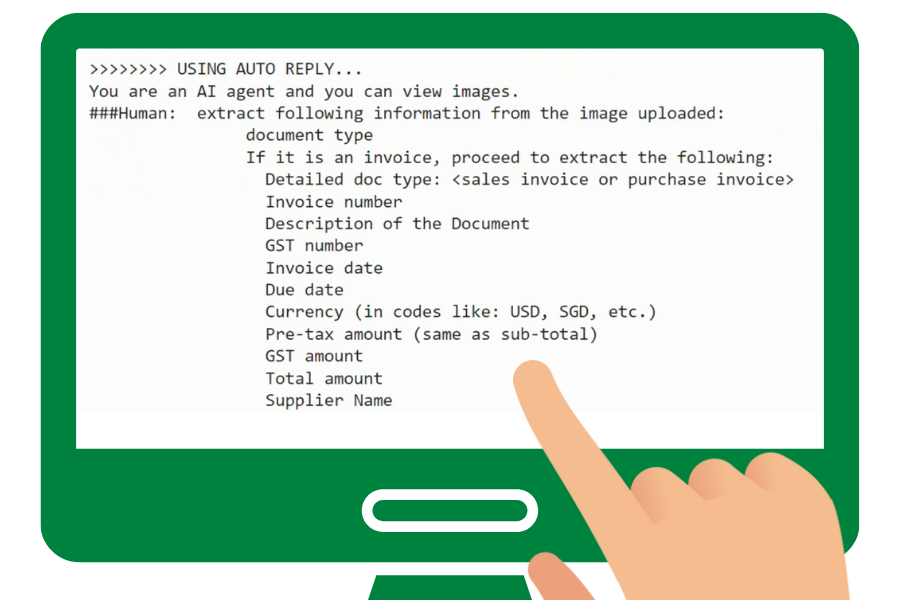

4. Set Up Automatic Payments:

Simplify administrative tasks and ensure punctual disbursements with automated systems.

Summary

As the captain of your company, you have the power to steer its financial course. By leveraging the strategies outlined in this handbook, you can navigate salary payments with confidence, maximising financial stability, tax efficiency, and legal compliance. Remember, informed decisions and proactive planning are the keys to success in business ownership.

Experience the Counto advantage

Counto is the trusted provider of accounting, tax preparation and CFO services for startups and SMEs. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price. To learn more, speak to us directly on our chatbot, email us at [email protected], or contact us using this form.

Here are some articles you might find helpful: