Having a reliable accounting system is important for every small business. By doing so, you can keep your business goals on track, and use your data to manage and project cash flows accurately.

Here is an accounting checklist containing the key tasks that you can carry out to simplify and streamline the financial workflow.

Daily Tasks

1. Check cash position

We often hear the phrase ‘Cash is King’, and that is obvious in some ways. Cash often makes up the large part of assets for small businesses, and thus managing it well is vital to a smooth operation. You should check your cash flow and monitor it’s projection daily.

This is to ensure that the balance remains healthy, so that your business can still afford the upcoming expenses. By factoring in accounts receivable and accounts payable, this will provide a clearer picture of the assets and liabilities of your business.

2. Record daily transactions

Recording every incoming and outgoing transaction is important so that bookkeeping can be properly done without mismatch in cash flows. Incoming transactions refer to those such as receiving cash or credit from customers, while outgoing refer to paying of suppliers.

Some businesses may choose to record these transactions manually in Excel, but it can get overwhelming as your transaction volume gets larger.

3. Document invoices

Apart from recording transactions, you should keep copies of all invoices received and issued. This helps to ensure that every sale and purchase is accounted for, and the proof of purchase remains in the accounts. In fact, it is a requirement by the Inland Revenue Authority of Singapore (IRAS) to keep proper records of accounts for minimally 5 years. This would also help nearing the year-end period, where all businesses are required to file taxes with IRAS.

Weekly

4. Review vendor transactions

Vendor payments should be carried out efficiently so as to maintain a healthy financial position, and a long standing relationship with your vendors. It is important to update your accounts payable weekly to add in the vendor bills that you receive, so these payments are made before the due date.

Many suppliers often have purchase discounts, which entitles a certain percentage of discount if payments are made within the indicated date. This would be beneficial to small businesses as it increases savings, especially if you purchase items in bulk. In the same vein, late payments may result in penalties that would be disadvantageous to your business.

5. Prepare and send invoices

Prepare a proper invoice that indicates your company details, invoice number, date, goods or services sold, and payment terms. The invoice number allows you to easily identify transactions, while the payment terms allow you to better predict your revenue. It also makes it clearer to clients when payment is due, and the overdue charges.

6. Review projected cash flow

After the previous steps, you would probably have a greater understanding of your expenses and sales for the upcoming weeks. Using that information, it is good to forecast your cash flow to visualise how much in total you would need to pay, compared to how much you expect to receive. This can be done by simply collating your cash receipts and bills, and comparing it to the current cash position.

Monthly

7. Reconcile your books

Balancing your books is critical to ensure that the cash recorded is the same as the cash collected. This minimises the amount of errors that go into projecting your upcoming cash positions, and ensures that no cash is missing.

8. Review aged receivables

Aged receivables are basically accounts receivable from customers that are overdue. By reviewing these transactions according to the invoices previously issued, you will better know who has not paid and when it’s time to collect payments. After all, an increase in receivables may not always be a good thing as it could be due to these aged receivables, indicating that cash is not duly collected.

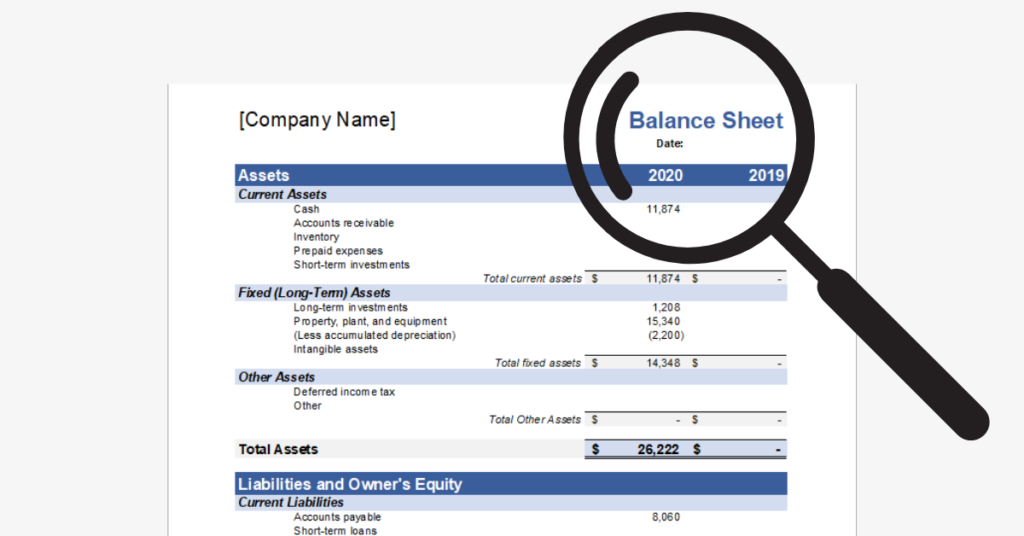

9. Review balance sheet

Monitoring your balance sheet monthly helps to verify if your projected cash flow matches the actual sales, and if not, what has caused the difference. By comparing your balance sheet at the end of month to previous dates, it will be easy to understand what has improved or deteriorated.

Work with the expert accounting team your business deserves. Learn how Counto can take bookkeeping stress off your plate for good. Talk to us today.