Converting from LLP to Pte Ltd in Singapore: A Step-by-Step Guide

Why Convert from LLP to Pte Ltd?

Converting your Limited Liability Partnership (LLP) to a Private Limited (Pte Ltd) company in Singapore offers numerous benefits:

- Limited Liability: Pte Ltd companies provide owners with limited liability protection, separating personal assets from business liabilities.

- Tax Advantages: Access exclusive tax incentives and schemes available only to private limited companies, potentially reducing tax liabilities and enhancing profitability.

- Funding Flexibility: Pte Ltd companies enjoy broader funding-raising options, facilitating business growth and expansion.

- Enhanced Credibility: Private limited companies often enjoy greater credibility and trust among clients and customers, leading to increased business opportunities.

The Conversion Process

1. Consent:

- The business owner must draft a No Objection Letter, formally indicating consent to convert the LLP to a Pte Ltd company.

- Clearly state the reasons for the conversion and intentions regarding the business name.

2. Incorporation:

- Incorporate the private limited company, adhering to specific requirements and paying the necessary fees.

- Obtain a registered mailing address, appoint a local resident director, and engage a company secretary within six months of incorporation.

- Remember to close the LLP within three months of establishing the Pte Ltd company.

3. Asset Transfer:

- Identify and transfer assets and liabilities from the LLP to the newly-formed Pte Ltd company.

- Consider asset breakdown in terms of share capital and assess asset values accurately.

- Seek professional assistance from accounting firms in Singapore to ensure a smooth and efficient transfer process.

- Key considerations include transferring net assets, closing LLP bank accounts, updating rental agreements and contracts, and reapplying for licences and permits if necessary.

4. Cessation:

- Submit a Notice of Cessation to the Accounting and Corporate Regulatory Authority (ACRA) within three months of incorporating the Pte Ltd company.

- Confirm the closure of the LLP to finalise the conversion process.

Summary

Converting from LLP to Pte Ltd in Singapore requires careful planning and execution to maximise benefits. Follow these steps and seek professional assistance for a seamless transition, unlocking new opportunities for business growth and success.

Try Counto’s company secretary service

Running a company in Singapore can be challenging, but with professional support, it can be simple. Counto’s goal is to take away the complexities of compliance, and save you time and money throughout the year. To learn more, speak to us directly on our chatbot, email us at [email protected], or contact us using this form.

Here are some articles you might find helpful:

Post

EntrePass in Singapore: Gateway for Global Innovators and Entrepreneurs The Entrepreneur Pass (EntrePass) is a strategic initiative designed for ambitious foreign entrepreneurs, innovators, and investors looking to launch and operate…

Read More Quick Ratio: A Liquidity Metric for Small Businesses

Quick Ratio: A Liquidity Metric for Small Businesses For small business owners, mastering financial metrics is crucial, and the Quick Ratio is an essential tool. This straightforward indicator helps assess…

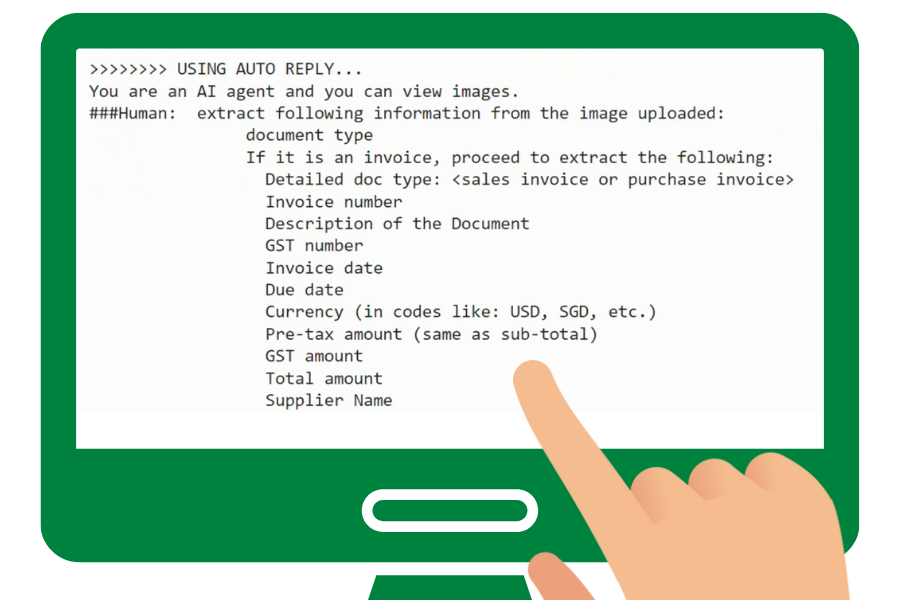

Read More Making Big Strides with AI: The Counto Multi-Agent Compliance Model

Making Big Strides with AI: The Counto Multi-Agent Compliance Model At Counto, we constantly innovate to simplify complex compliance tasks for our small business clients. Our latest breakthrough? A multi-agent…

Read More How Small Businesses Can Thrive Under Singapore’s New Flexible Work Arrangements (FWA)

How Small Businesses Can Thrive Under Singapore’s New Flexible Work Arrangements (FWA) As of December 1, 2024, all employers in Singapore, including small businesses, will be required to fairly consider…

Read More Mastering Remote Employee Onboarding: A Strategic Guide for SMEs

Mastering Remote Employee Onboarding: A Strategic Guide for SMEs Remote work has transformed how we onboard new employees, making it essential for businesses, especially SMEs, to adapt their onboarding processes…

Read More A Guide to New FWA Guidelines for Singapore SMEs from Dec 2024

A Guide to New FWA Guidelines for Singapore SMEs from Dec 2024 Starting December 1, 2024, Singapore will see a significant shift towards supporting flexible work arrangements (FWAs), as mandated…

Read More