Easy Guide to Converting Your Sole Proprietorship to a Private Limited Company

Are you a sole proprietor and eyeing the transition to a Private Limited (Pte Ltd) company? This guide will walk you through the process, highlighting the advantages, essential steps, and key considerations for a smooth conversion. Let’s explore how this transformation can propel your business towards greater success and prosperity.

Advantages of Converting from Sole Proprietorship to Pte Ltd

- Limited Liability Protection: Shield your personal assets from business liabilities with the limited liability protection offered by Pte Ltd companies.

- Tax Efficiency: Enjoy tax benefits with taxes paid on profits but dividends to shareholders not subject to taxation, resulting in significant savings.

- Enhanced Credibility: Elevate your business’s credibility and professionalism, opening doors to larger opportunities and partnerships.

- Access to Capital: Expand your funding options and attract investors by issuing shares, facilitating business growth and expansion.

- Perpetual Succession: Ensure continuity and longevity for your business beyond your lifespan, with perpetual succession as a Pte Ltd company.

Steps to Transition from Sole Proprietorship to Pte Ltd

1. Prepare for Conversion:

- If you’re looking to register your Singapore Pte Ltd company using your current sole proprietorship business name, you’ll need to provide a ‘No Objection Letter’ to the Company Registrar, outlining your reasons for retaining the business name and disclosing any shared ownership between the entities.

- Resolve any outstanding debts or liabilities of the Sole Proprietorship before initiating the conversion process.

2. Incorporate a Pte Ltd Company:

- Reserve a unique company name for your Pte Ltd company through the ACRA’s BizFile+ portal.

- Prepare incorporation documents, including the Memorandum and Articles of Association and Form 45.

- File the conversion application with ACRA, submit necessary documents, and pay the conversion fee.

3. Transfer Assets and Contracts:

- Close bank accounts associated with the Sole Proprietorship and open new accounts for the Pte Ltd company.

- Transfer assets, contracts, licences, and permits from the Sole Proprietorship to the Pte Ltd company.

- Revise existing contracts and agreements to align with the new entity, ensuring all legal documents are updated accordingly.

4. Finalise Conversion and Closure:

- Receive the new business registration number for the Pte Ltd company upon ACRA’s approval of the conversion application.

- Notify stakeholders, including customers, suppliers, and government agencies, of the business’s conversion.

- Submit a Notice of Cessation to ACRA to officially terminate the Sole Proprietorship’s operations.

Summary

Switching from a Sole Proprietorship to a Private Limited Company in Singapore unlocks a world of opportunities for growth, financial security, and credibility. By following the outlined steps and seeking professional guidance when needed, sole proprietors can seamlessly transition to a Pte Ltd company, and embark on a journey towards greater success.

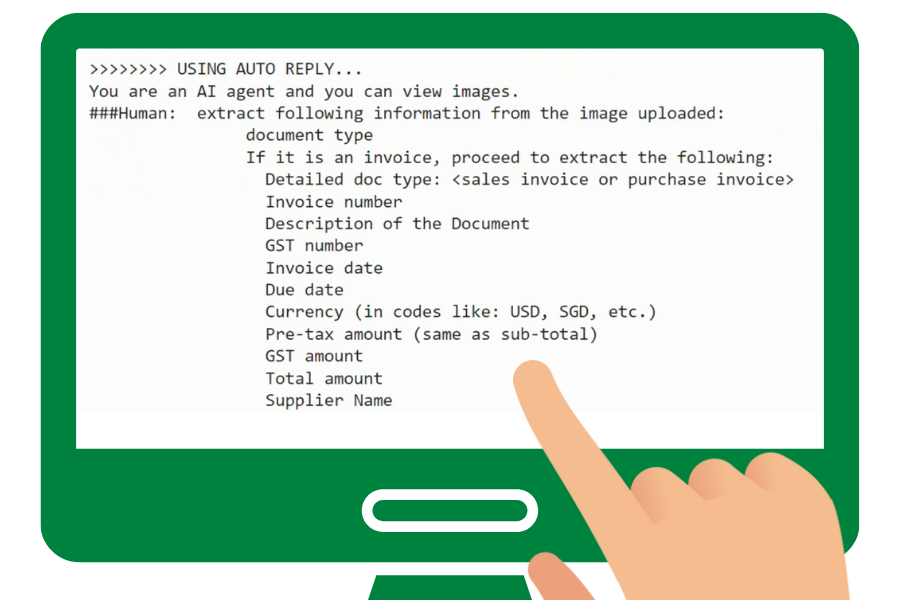

Using an incorporation service as an extension of your team

Setting up a company in Singapore can be challenging, but with professional support, it can be simple. Counto’s mission is to support your new business, take away the complexities of compliance, and save you time and money throughout the year. Speak to us directly on our chatbot, email us at [email protected], or contact us using this form.

Here are some articles you might find helpful:

Filing requirements for Pte Ltd companies