“Cash cold that’s what I need / These bill collectors they ring my phone / They bother me when I’m not at home / Ain’t go no time to be fooling round” – Calloway singing “I wanna be rich” is, of course, the worst-case scenario of any floundering business.

Finance tracking and management are often overlooked or improperly handled by many business owners, especially the smallest ones.

Those ramifications can have lasting impact. Research shows that seven out of ten small business owners cite cash flow issues as the biggest threat to company longevity.

While it’s important to devote time to building your brand, it’s imperative to have real-time visibility over all the money going in and out of your accounts.

We present three simple ways to keep your cash flow pumping:

(1) Establishing money & task management systems from the start!

Running cash flow analysis on a weekly (or monthly) basis can help pinpoint the components of your business that affect cash flow, such as accounts receivable and inventory.

If you don’t receive payments on time, your business won’t survive. Set up recurring reminders and payment invoices to customers, so you avoid disruptions to your cash flow.

(2) Ditching the “do-it-all” mentality!

Entrepreneurship is often a solo (and sometimes lonely) endeavour. The weight of responsibility is immense and you can find yourself knee-deep in the mechanics of doing everything yourself.

Seek help especially in areas that you lack expertise, so you can focus your time and energy on adding value to other aspects of your operations.

Consider the fact that you don’t want to spend off-hours doing accounting and taxes. QuickBooks and Xero are great software options for small-business accounting, and both can be managed from the cloud. A fuss-free option is to delegate all your bookkeeping to an accounting services firm like Counto.

(3) Automate, automate, automate!

The world is constantly evolving—when it comes to technology, the more tasks you can put on autopilot, the better.

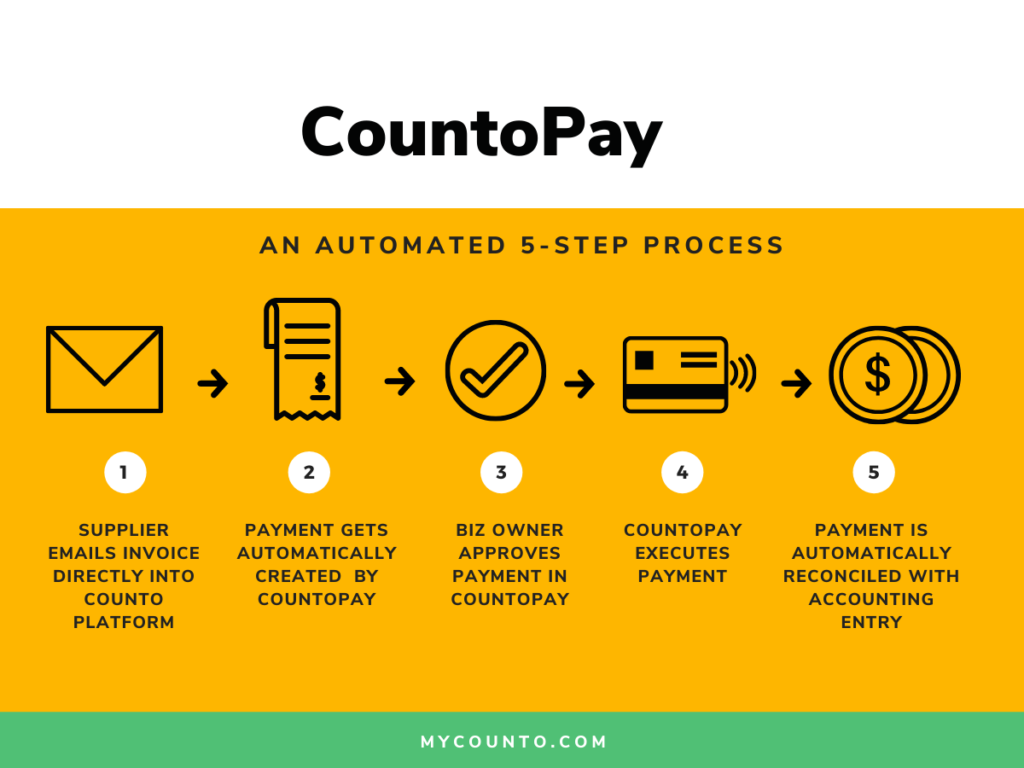

For example, our artificial intelligence technology uses advanced machine learning trained daily on data from your uploaded documents. Over time, it fine-tunes itself to automatically eliminate common errors and deliver much more accurate financials.

As a small business owner, you’ll need to adopt forward-thinking accounting measures in order to ensure that your cash flow and operations have the ability to grow—using the least financial outlay and effort.

There are strategies and options available to avoid all the pitfalls that seem to entangle the majority of small companies. The question is how fast are YOU willing to adapt to change and find that light at the end of the tunnel?

Try Counto for free today! We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Contact us now!