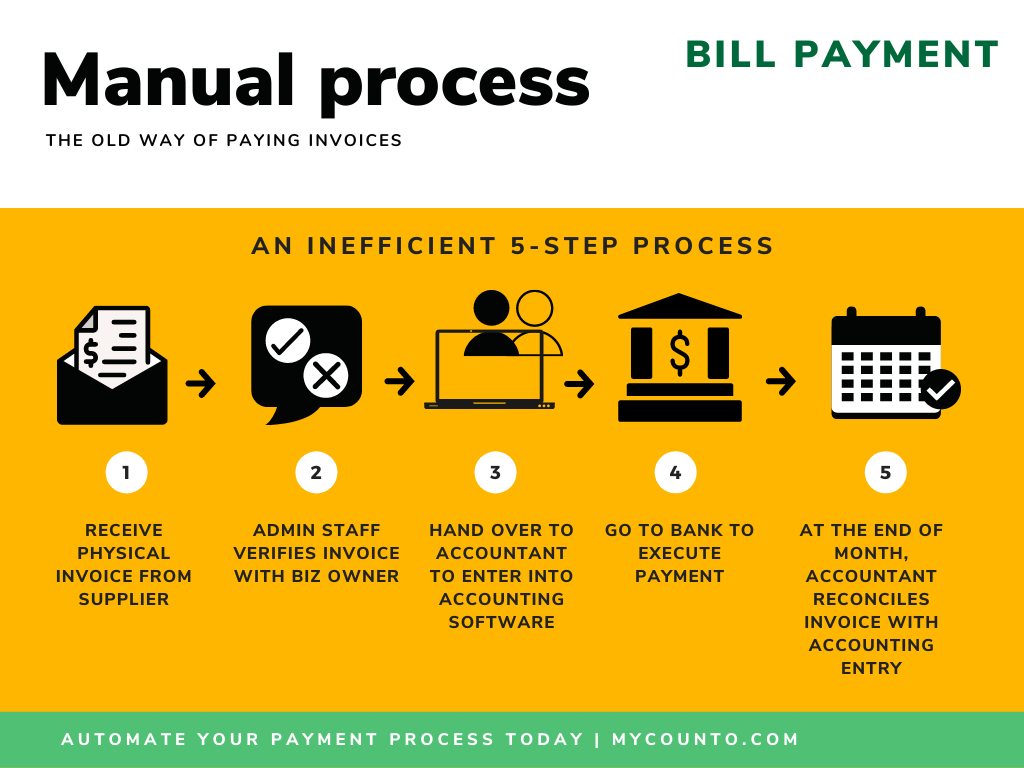

How do you pay your business bills now? For most businesses, this is a tedious, manual process, and typically looks like this:

- Admin staff receives an invoice and passes it to the bookkeeper.

- The bookkeeper creates the accounting entry in the accounting software, files the invoice in a paper binder, and creates the payment in the bank for the owner to approve.

- Owner logs into the bank to either approve the payment, and/or frequently, modifies the amount, which involves recreating the payment.

- The bookkeeper then reconciles the final amount at the end of the month between the accounting and bank data.

This entire process takes about 30 minutes and is error prone, given the number of people involved. For businesses that process a high number of payments, you can imagine how automating this entire process would make life a lot easier.

CountoPay is a payment solution designed for automating the above workflow for Counto’s customers. CountoPay syncs with Spenmo, a homegrown cloud payment software, and is available to all Counto accounting and Virtual CFO clients.

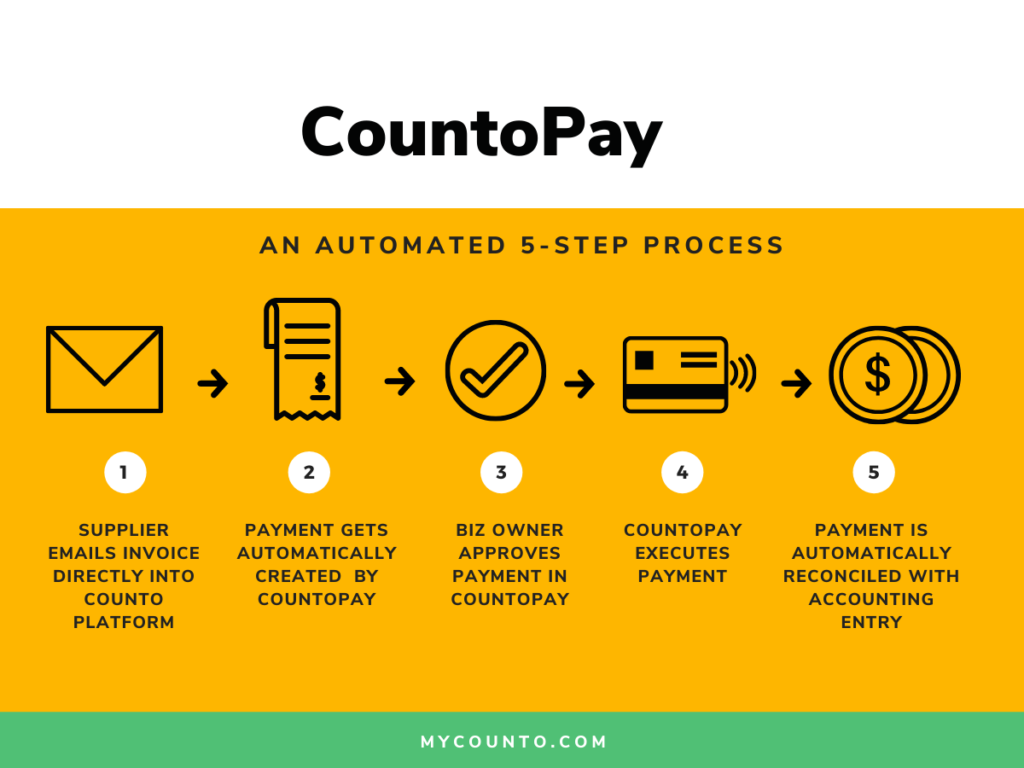

How CountoPay works

- When an invoice comes in, the business’ admin staff can directly forward the invoice into Counto along with a simple command like: Pay “Supplier Inc” $100 on Jan 25.

- Counto’s AI systems automatically extract all the payment data from the invoice, store the invoice in Counto’s Vault, and create a Draft payment in CountoPay.

- The owner is able to modify and approve with one click within CountoPay, and the payment is settled through CountoPay’s seamless interface with Spenmo.

- This simplified bill payment process only takes about 5 minutes and is error free. Plus, you can see your Spenmo wallet balance in real time.

Simpler way of handling your accounts payable (AP)

– The average cost of handling an invoice is estimated to be the equivalent of the cost of 30 minutes of work for an employee vs. five minutes using CountoPay.

– Having data that are automatically entered correctly, in real time, allows accurate and useful financial reporting with no additional labour strain.

– Thus, freeing up time for higher value work, and driving activities such as growth planning and cash flow forecasts.

With Counto’s tie-up with Spenmo, you get even more benefits

– Cheap international transfers with the lowest rates in the market.

– Instant access to corporate cards with pre-approved funds.

– Ability to manage and control your employees’ spending.

Huge opportunities when you automate

Invoice processing is one of the most critical aspects of AP, and should be properly managed from the start.

It has been reported that it can cost up to $25 to manually process one invoice. Though the benefits of an automated payment system extend far beyond a business’ profitability.

With CountoPay, you are in complete control of the payment process. Instead of manually entering mind-numbing data for hours, your employees can work smarter, quicker, and feel more productive.

You can find CountoPay on the Counto accounting platform, which is specifically built for clients to monitor all their business finances seamlessly, in one place. Advanced analytics? Check. Cash flow report? Check. Upload and store unlimited documents? Check. Built-in chat window for your Counto accountant to quickly answer all your questions? Check.

In this digital age, being more efficient is not only desirable but crucial to driving strategy and business growth. That, more than anything else, is why CountoPay is well worth a try.

CountoPay is a free service offering that is available to all Counto accounting and Virtual CFO customers. Contact us today for a free demo, and see how you can optimise your business operations.