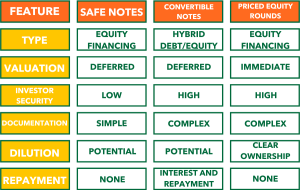

SAFE Notes vs. Convertible Notes vs. Priced Equity Rounds: Choosing the Right Fundraising Method for Your Startup

For startups in Singapore, selecting the appropriate fundraising method is crucial for growth and financial health. SAFE notes, convertible notes, and priced equity rounds each offer unique benefits and considerations. Understanding these options can help you make an informed decision that aligns with your startup’s needs.

1. SAFE Notes: Streamlined Equity Financing

SAFE (Simple Agreement for Future Equity) notes provide a straightforward way to raise capital without needing to establish a valuation immediately.

Advantages:

- Ease of Use: Minimal paperwork and a quick process for raising funds.

- Valuation Flexibility: Allows valuation to be determined in a future funding round, simplifying early-stage fundraising.

Disadvantages:

- Potential Dilution: Future equity conversion can dilute the ownership stakes of the founders.

- Uncertain Terms: Final equity terms are set later, which can introduce uncertainty for early investors.

Example: A tech startup might use SAFE notes to raise initial capital quickly, with the understanding that equity terms will be determined in a subsequent round.

2. Convertible Notes: Hybrid Debt and Equity

Convertible notes start as debt but convert into equity based on predefined conditions, offering a blend of debt and equity financing.

Advantages:

- Investor Security: Includes interest payments and potential repayment, offering added security to investors.

- Deferred Valuation: Delays the need for immediate valuation, which can simplify early fundraising efforts.

✅ Tired of surprise fees from accounting services? We prioritise your savings and efficiency. From multicurrency accounting to tax filing, Counto handles it all—with unlimited transactions. Explore our transparent, all-in-one pricing here.

Disadvantages:

- Complexity: Involves more detailed legal and financial documentation compared to SAFE notes.

- Debt Burden: Carries interest and has a maturity date, potentially adding financial pressure.

Example: A biotech company might opt for convertible notes to secure investment with the added security of debt while deferring valuation to a later stage.

3. Priced Equity Rounds: Clear Valuation and Ownership

Priced equity rounds involve issuing shares at a set price, requiring an immediate valuation of the company.

Advantages:

- Clarity: Provides clear terms and defined ownership stakes, making it transparent for investors.

- Suitable for Later Stages: Ideal for startups with a well-established valuation and financial outlook.

Disadvantages:

- Complex Valuation: Establishing an accurate valuation can be complex and costly.

- Lengthy Process: Negotiations can be time-consuming, potentially delaying the fundraising process.

Example: An established fintech startup might choose a priced equity round to secure significant investment with clear terms and valuation.

Legal and Tax Implications

- SAFE Notes: Generally less complex legally, but it’s crucial to review terms to avoid unexpected dilution.

- Convertible Notes: Requires careful legal documentation to ensure fair and clear terms of conversion.

- Priced Equity Rounds: Involves detailed legal agreements and valuation processes, which can be more costly and time-consuming.

Summary

SAFE notes offer simplicity and valuation flexibility but may lead to future dilution and uncertain terms. Convertible notes provide a hybrid approach with investor security but involve complex documentation and debt obligations. Priced equity rounds ensure clear ownership and valuation but require detailed and often lengthy negotiations. Choosing the right method depends on your startup’s stage, needs, and investor preferences.

Switch to a trusted Outsourced Accounting Service

Counto exists to help small businesses like you save time and money throughout the year. Get direct access to a dedicated Customer Success Manager, who’s backed by a team of accountants and tax specialists. Discover a smarter way to outsource your accounting with confidence.Speak to us directly on our chatbot, email [email protected], or use our contact form to get started.

Here are some articles you might find helpful: