Sole Proprietorship vs Pte Ltd – Which One Is Right for You?

When venturing into the business world in Singapore, one of the foremost decisions you’ll make is selecting the appropriate business structure. For entrepreneurs, the choice often boils down to two main options: sole proprietorship and private limited company (Pte Ltd). Each structure carries its unique advantages and challenges, making a well-informed decision critical for your business’s success.

What is a Sole Proprietorship?

In its essence, a sole proprietorship represents the epitome of simplicity in business structure. With a single owner at the helm, it’s an easy and cost-effective way to kickstart your entrepreneurial journey. However, it comes with a caveat – the owner and the business are one and the same, exposing the owner to unlimited liability.

Advantages of Sole Proprietorship

- Ease of Setup: Registering a sole proprietorship involves minimal formalities and costs, making it an attractive option for budding entrepreneurs.

- Cost-Effectiveness: Sole proprietors benefit from reduced compliance requirements and administrative burdens.

- Sole Control: As the sole owner, you enjoy complete autonomy over business decisions and operations.

- Flexible Termination: Should the need arise, terminating a sole proprietorship is a straightforward process.

Disadvantages of Sole Proprietorship

- Unlimited Liability: The owner bears full responsibility for the business’s debts and obligations, risking personal assets.

- Limited Capital: Sole proprietors may encounter challenges in accessing external funding due to perceived higher risk.

- Taxation: Business profits are taxed as personal income, potentially subjecting the owner to higher tax rates.

What is a Private Limited Company (Pte Ltd)?

For entrepreneurs looking to incorporate a business, a private limited company (Pte Ltd) offers a more robust and scalable business structure. It provides limited liability protection to its shareholders, distinct from the company itself. This means that the personal assets of shareholders are safeguarded in case of business liabilities, offering peace of mind and security.

Advantages of Pte Ltd in Singapore

- Limited Liability: Shareholders’ personal assets are shielded from business liabilities, minimising individual risk.

- Tax Benefits: Private limited companies enjoy lower corporate tax rates and are eligible for tax incentives and exemptions.

- Separate Legal Entity: A Pte Ltd exists as a distinct legal entity, enabling smoother ownership transfer and perpetual succession.

- Enhanced Credibility: The corporate structure enhances the company’s credibility and facilitates easier access to funding and investments.

Disadvantages of Pte Ltd in Singapore

- Compliance Requirements: Pte Ltds must adhere to stricter compliance standards, involving more administrative obligations and higher operational costs.

- Complex Setup: Forming a private limited company entails more formalities and expenses compared to sole proprietorship.

- Disclosure Requirements: Directors must disclose company information, contracts, and interests, ensuring transparency but also exposing internal details.

Summary of the Key Differences between Pte Ltd companies and Sole Proprietorships in Singapore.

Private Limited Company (Pte Ltd) Sole Proprietorship

Number of owners Minimum of 1; Maximum of 50 Owned by 1 person

Who can set up Any foreign &/or local individual &/or company

Must appoint a local directorSingapore citizen / Singapore Permanent Resident / Employment Pass / Dependent Pass / Foreigner (must appoint a local manager)

Best for Most popular, advanced and scalable business structure

Eligible for tax exemptions and ease of raising capSimplest option to be run by an individual

Second most popular option after Pte Ltd

Legal status Separate legal entity distinct from its shareholders Not a separate legal entity

Liability Limited liability for shareholders Owner has unlimited liability for debts and losses

Raising capital Can raise capital via share issuance

Easier to get access to funding from banks and investorsSolely reliant on owner's funds and business earnings.

Limited access to external financing as it's contingent on owner's credibility and financial standing

Grant eligibility Meets the criteria for Startup SG and various business grants Does not meet criteria for Startup SG and limited options for grants

Taxation Taxed at a flat rate of 17% Taxed at personal income tax rate

Tax exemptions Eligible companies can claim 75% tax exemption on the first S$100,000 of their chargeable income

Companies ineligible for the tax exemption scheme can still benefit from partial tax exemption (75% exemption on the 1st $10,000 of chargeable income; plus additional 50% exemption on the subsequent $190,000)Personal tax relief if applicable

Formalities More costly to set up (registration fees, ongoing compliance costs, etc)

Must appoint a company secretary within 6 months of incorporation

Must maintain proper records and financial transactions for at least 5 years from the relevant Year of Assessment

Must file annual returnsEasy to set up

Minimal compliance requirements and registration cost

Registration to be renewed annually

Government set up fee $315 ($15 name application fee; $300 incorporation fee) 1 year registration: $115 ($15 name application fee; $100 incorporation fee)

3 year registration: $175 ($15 name application fee; $160 incorporation fee)

Business Continuity Perpetual succession until wound up or struck off

Difficult to transfer ownershipBy owner: Termination upon owner's demise

By registrar: If registration expires without renewal

Choosing the Right Business Structure

Deciding between a sole proprietorship and a private limited company when incorporating a company hinges on various factors: your business goals, risk tolerance, capital requirements, and long-term vision.

While sole proprietorships offer simplicity and cost-effectiveness, they come with inherent risks of unlimited liability. On the other hand, Pte Ltds provide limited liability protection, tax benefits, and scalability but entail higher setup costs and compliance obligations.

Consulting with an accountant or company incorporation service can provide valuable insights tailored to your specific circumstances, aiding in making an informed decision aligned with your business objectives.

Tax Implications: Sole Proprietorship vs Pte Ltd

The disparity in tax treatment between sole proprietorships and private limited companies further influences the decision-making process. Sole proprietors are taxed on business profits as personal income, while Pte Ltds are subject to corporate tax rates on chargeable income. Additionally, directors’ salaries and benefits in Pte Ltds are taxed separately, offering potential tax planning opportunities.

Converting from Sole Proprietorship to Pte Ltd

Switching from a sole proprietorship to a private limited company involves specific steps:

- Obtain No-Objection Letter: Secure permission to retain your business name for the new private limited company.

- Incorporation Process: Prepare required incorporation documents and submit them to ACRA.

- Appointment of Shareholders and Directors: Select shareholders and directors for the new company. Often, the sole proprietor becomes both.

- Transfer of Assets and Liabilities: Move assets and liabilities from the sole proprietorship to the new company, including contracts and agreements.

- Tax Registration: Register the new company for taxes, such as GST if applicable.

- Closure of Sole Proprietorship: Inform ACRA and other relevant authorities about the closure of the sole proprietorship.

- Compliance Requirements: Fulfil all compliance obligations for private limited companies, such as holding annual general meetings and filing annual returns with ACRA.

- Bank Accounts and Licences: Open a new bank account for the company and transfer any necessary licences or permits.

Summary

Choosing between a sole proprietorship and a Pte Ltd in Singapore requires careful evaluation of liability, taxation, and growth ambitions. Ensure your company’s long-term success by consulting with a professional company incorporation service like Counto for strategic advice and support.

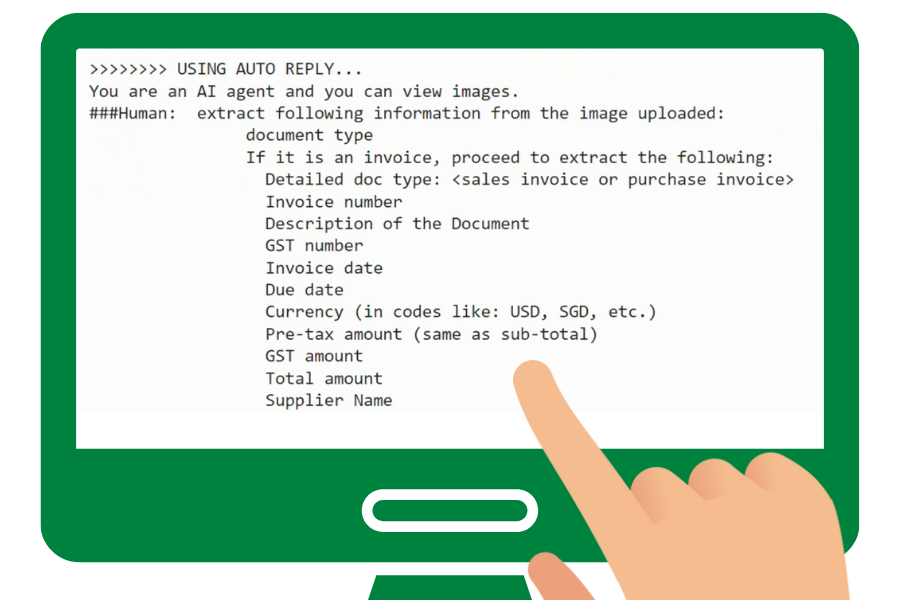

Using an incorporation service as an extension of your team

Setting up a company in Singapore can be challenging, but with professional support, it can be simple. Counto’s mission is to support your new business, take away the complexities of compliance, and save you time and money throughout the year. Speak to us directly on our chatbot, email us at [email protected], or contact us using this form.

Here are some articles you might find helpful: