Understanding Audit Requirements for Private Limited Companies in Singapore

As a private limited company in Singapore, understanding audit requirements is crucial for maintaining financial transparency and compliance. Whether your business has reached the stage where an audit is required or you’re looking to better understand the process, this guide provides the necessary insights. We’ll cover everything from audit exemptions to corporate secretarial responsibilities, timelines, costs, and practical advice for navigating the audit process.

What is an Audit?

An audit is an independent examination of a company’s financial statements by a licensed auditor. The purpose is to ensure that the financial statements accurately reflect the company’s financial position and comply with the Singapore Financial Reporting Standards (SFRS) and the Companies Act.

- Purpose: Verify that the financial statements present a true and fair view.

- Compliance: Ensure adherence to SFRS and the Companies Act.

Example: If you run a software development company in Singapore and your annual revenue exceeds S$10 million due to expansion, you would need to undergo an audit. This process ensures your financial statements reflect your business’s true financial health, providing stakeholders with confidence in your company.

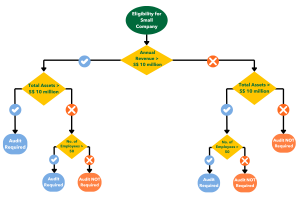

Audit Exemptions: Small Company and Small Group Criteria

Not all companies in Singapore are required to undergo an audit. Your company may be exempt if it qualifies as a “small company.” This depends on meeting at least two of the following three criteria for the past two consecutive financial years:

- Total annual revenue does not exceed S$10 million.

- Total assets do not exceed S$10 million.

- Number of employees does not exceed 50.

Small Group Exemption

- If your company is part of a group, the entire group must meet these criteria to qualify for the exemption. If the group exceeds these thresholds, the holding company will need to prepare consolidated financial statements and undergo an audit.

Example: If your IT consultancy firm is the holding company of several subsidiaries, but the group’s total revenue exceeds S$10 million, the group won’t qualify for the small group exemption. Consequently, the holding company will need to prepare consolidated financial statements and have them audited.

Corporate Secretarial Responsibilities: Appointing an Auditor

As a company director, you have specific responsibilities when it comes to appointing an auditor:

- When to Appoint: Every company required to audit its financial statements must appoint an auditor within three months of incorporation. Auditors are reappointed at each Annual General Meeting (AGM).

- Reappointment: While no statutory limits exist on how long an auditor can serve the same company, it is advisable to periodically review performance and consider auditor rotation to maintain audit quality.

Example: If your software development company has been working with the same auditor for a decade, it might be wise to review their performance. Changing auditors can bring fresh perspectives and enhance audit quality.

✅ At Counto, we prioritise your bottom line. Our expert accountants deliver comprehensive services—from bookkeeping to tax filing—at transparent rates. Explore our all-in accounting plans and keep more of what you earn.

Why is an Audit Important?

Audits aren’t just legal requirements; they’re valuable tools for your business. Here’s why:

- Credibility and Trust: Audited financial statements give investors, banks, and partners confidence in your company’s financial standing.

- Regulatory Compliance: Audits ensure compliance with SFRS and the Companies Act, preventing penalties and legal issues.

- Internal Controls: An audit highlights weaknesses in your internal controls, helping you improve your financial management.

Example: After rapid growth, a Singapore-based software company undergoes an audit. While revenue recognition processes are sound, the audit reveals gaps in project cost tracking. This insight allows the company to streamline its expense tracking and improve budget control, enhancing profitability.

The Audit Process: What to Expect

Understanding the audit process helps ensure smoother compliance. Here’s an overview:

1. Engage an Auditor: Select a qualified auditor who is a Public Accountant registered with the Accounting and Corporate Regulatory Authority (ACRA).

2. Planning the Audit: The auditor reviews your business, risks, and audit scope. This involves meetings and discussions to set expectations and timelines.

3. Fieldwork: The auditor reviews your financial records, such as invoices and bank statements, and interviews key personnel.

4. Review and Testing: The auditor tests your financial data for inconsistencies or errors.

5. Audit Report: After completing the audit, the auditor issues a report confirming whether your financial statements fairly represent your financial position.

Example: For a retail business, auditors may focus on cash handling and inventory management, both high-risk areas.

Preparing for an Audit: Tips for Small Business Owners

Being prepared ensures a smooth audit process. Consider the following tips:

- Maintain Organised Records: Keep your financial documents, such as invoices and bank statements, well-organised and up to date.

- Understand Your Financial Statements: Familiarity with your financial statements helps you grasp the audit process.

- Communicate with Your Auditor: Open communication with your auditor is key—ask questions and clarify any doubts.

- Conduct a Pre-Audit Review: An internal review before the official audit can highlight issues to resolve beforehand.

Example: A small marketing agency’s pre-audit review reveals discrepancies in accounts receivable. Addressing these before the official audit avoids potential delays.

Beyond the Audit: What Comes Next?

An audit provides valuable insights that go beyond compliance. Use the findings to improve your business operations:

- Implement Changes: Address the audit’s findings to enhance your financial management and internal controls.

Example: After an audit, a manufacturing company identifies the need for better cost controls. By implementing new budgeting procedures, they reduce expenses and boost profitability.

Costs and Timelines

Understanding the costs and timelines involved in an audit can help with preparation:

- Cost of an Audit: Audit fees for small to medium-sized enterprises (SMEs) in Singapore range from S$5,000 to S$20,000, depending on company size and complexity.

- Timeline: The audit process typically takes several weeks to a few months, depending on the audit scope and company size. Early preparation is crucial to avoid delays.

Example: If your company’s financial year ends in December, aim to have your financial statements ready by February or March. This allows enough time for the audit to be completed before your AGM.

Group Audit Considerations

For companies with subsidiaries, the audit process involves additional steps:

- Consolidated Financial Statements: Holding companies must prepare consolidated financial statements, covering the financial results of all subsidiaries.

- Audit of Subsidiaries: Each subsidiary must undergo an audit unless it qualifies as a small company. The results will be included in the group’s consolidated financial statements.

- Corporate Shareholding: Inter-company transactions, cross-shareholdings, and related-party transactions must be carefully documented and disclosed.

Example: If your IT firm owns a digital marketing agency, both entities will need separate audits unless they qualify for the small company exemption. The group’s consolidated financial statements will reflect both businesses’ performance.

Frequently Asked Questions

1. Do I need an audit if my company is small?

If your company qualifies as a small company, you may be exempt from an audit. However, review these criteria annually, as growth could change your audit requirements.

2. How do I choose an auditor?

Selecting an auditor requires careful consideration of their industry experience, reputation, and fees. We can assist you in finding a qualified auditor who suits your business needs.

3. What if my group exceeds the small group threshold?

If your group no longer qualifies for the small group exemption, your holding company will need to prepare consolidated financial statements and undergo an audit. We can guide you through this process to ensure compliance.

Summary

Audits play a crucial role in maintaining your company’s financial integrity and transparency. Whether you’re navigating audit exemption criteria or managing multiple subsidiaries, understanding audit obligations ensures compliance and boosts stakeholder confidence. Preparation, the right auditor, and proactive actions based on audit findings can help your business strengthen its financial management. If you have any questions or need guidance on your audit requirements, Counto is here to assist you through the process.

Experience the Counto advantage

Counto is the trusted outsourced provider of accounting, tax preparation and CFO services for startups and SMEs. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price. To learn more, speak to us directly on our chatbot, email [email protected], or use our contact form to get started.

Here are some articles you might find helpful: