Hiring Employees in Singapore for SMEs and Startups

Singapore’s dynamic market offers ample opportunities for SMEs and startups, but navigating the complexities of hiring can be challenging. This guide covers everything from understanding employment laws to integrating foreign talent, ensuring you’re well-prepared to build a strong team.

Understanding Singapore’s Labour Laws

Singapore’s Employment Act is the primary legislation governing employment practices. It stipulates basic terms and conditions of employment and covers most employees, excluding domestic workers, seafarers, and public servants.

- Key Provisions: The Act outlines regulations on working hours, rest days, overtime, public holidays, sick leave, and other essential employment standards. Both local and foreign employees covered under the Employment Act enjoy protections concerning working hours, leave entitlements, and termination requirements.

- Contractual Flexibility: For employees not covered by the Act, terms can be negotiated and detailed in a contract that binds both parties.

To promote a discrimination-free workplace, Singapore mandates:

- Non-Discriminatory Hiring: Employers must avoid discrimination based on age, gender, race, religion, and other non-job-related factors.

Attributes to avoid in job postings:

In line with Singapore’s commitment to fair employment practices:

- Prohibited Attributes: Job postings should not mention age, gender, marital status, race, religion, or language as these could imply discriminatory preferences.

- Focus on Merit: Advertisements should strictly outline the skills and qualifications necessary for the position, promoting equal opportunity.

Contractual Obligations

Employment Contracts:

- Must detail salary, job duties, working hours, leave entitlements, and termination clauses, aligning with statutory requirements to ensure clarity and compliance.

Hiring Local Employees

Hiring local employees involves straightforward statutory requirements:

- CPF Contributions: Employers must contribute to the Central Provident Fund (CPF) for Singaporean citizens and Permanent Residents. Check out our CPF guide here.

- Skills Development Levy: All employers must contribute to this levy, which funds workforce training and upgrading programs.

Hiring Foreign Employees: In-Depth Considerations

Expanding your team to include foreign talent involves several additional steps and considerations:

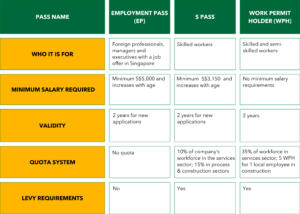

1. Work Visas and Passes:

- Employment Pass: Requires a minimum monthly salary of S$5,000, with higher thresholds for more experienced candidates. Employers must demonstrate a fair consideration of local candidates.

- S Pass: The salary threshold starts at S$3,150, with eligibility depending on qualifications and job scope. Companies must adhere to quota limits.

- Work Permit: Available for various sectors, with no minimum salary but strict quota limits. Employers are responsible for the worker’s medical insurance and a security bond.

~ Explore Counto’s all-inclusive accounting plans—designed to cover everything from multi-currency bookkeeping to unlimited transactions and corporate tax filing, all without hidden fees. Learn more about our accounting services here.

2. Quotas and Levies:

- Dependency Ratio Ceiling (DRC): This regulates the proportion of foreign workers a company can employ, varying by sector.

- Foreign Worker Levy: A levy must be paid for each Work Permit and S Pass holder, which varies based on the worker’s qualifications and sector.

Here’s an overview of the different work passes required based on the category of foreign talent you plan to hire in Singapore.

Financial Considerations in Hiring

Understanding the full cost of employment is vital for financial planning:

- Employee Benefits: This includes health insurance, bonuses, and other perks.

- Foreign Worker Levy: For S Pass and Work Permit holders, reflecting the government’s approach to regulate the number of foreign workers.

Recruitment Strategies

To effectively recruit the best talent, consider:

- Online Platforms and Agencies: Utilise job portals and recruitment firms to find suitable candidates.

- Industry Events: Participate in job fairs and networking events to connect directly with potential hires.

Salary Benchmarks

While Singapore does not enforce a minimum wage, employers are encouraged to offer competitive salaries that reflect the market rate for the role and industry, ensuring they attract the right talent.

Summary

For SMEs and startups in Singapore, hiring employees involves a nuanced approach that balances legal compliance with strategic HR practices. By adhering to Singapore’s employment regulations, maintaining fair employment practices, and setting clear contractual terms, businesses can foster a productive, inclusive workplace.

Try Counto’s full service payroll services

Counto is a modern payroll provider with the integrations, automations, and insights your business needs. Let our pro team handle your payroll from start to finish. Speak to us directly on our chatbot, email us at [email protected], or contact us using this form.

Here are some articles you might find helpful: